Corporate Tax & VAT

Why engage the services of Tax Experts?

Navigating the ever-evolving UAE’s tax landscape can be daunting, especially for individuals and businesses with complex financial situations. Engaging the services of FIRST LINK‘s tax experts offers several key advantages. We understand tax laws, deductions, and credits, providing you with maximum legal opportunities and avoiding costly mistakes.

Maximize Your Tax Benefits

Accurate and Timely Accounting

Your Trusted Partner for Tax

Corporate TAX Services

Engaging the services of tax experts is a strategic move for businesses aiming to navigate the complexities of tax regulations, ensure compliance, and optimize their financial performance. Here is a detailed look at the benefits of FIRST LINK’s corporate tax service:

- Registration with FTA and Ensuring Correct Application: Tax experts assist businesses in registering with the Federal Tax Authority (FTA), ensuring the application is accurately filled out and submitted. This initial step is critical for companies to start their operations in compliance with tax laws.

- Compliance with Tax Laws and Staying Up to Date with Changes: Tax regulations frequently change, and staying compliant requires a deep understanding of these laws. Tax professionals inform businesses about the latest tax regulations, helping them avoid penalties and maintain good standing with tax authorities.

- Assessment of CT Impact on Business Operations and Financials: Experts analyze how corporate taxes affect a company’s operations and financial health. This evaluation helps businesses understand their tax obligations and the effects on their bottom line, enabling strategic planning and decision-making.

- Training of Accounting Staff & Implementation of IFRS Accounting Standards: Tax professionals provide training on the International Financial Reporting Standards (IFRS) for accounting personnel, ensuring that financial reporting meets global standards. This training is crucial for accuracy in financial statements and compliance.

- Preparing Business for Tax Audits and Liaison with FTA: Preparing for a tax audit can be daunting. Tax experts prepare businesses for audits and act as intermediaries with the FTA, ensuring that the process is smooth and that the company is well-represented during audits.

- Tax Planning for the Business to Maximize Tax Savings: Strategic tax planning allows businesses to minimize their tax liabilities, thereby saving money legally. Tax experts identify opportunities for tax savings and advise on structuring transactions and operations in a tax-efficient manner.

- Filing Tax Returns to the FTA and Accurate Tax Assessment: Timely and accurate filing of tax returns is essential. Tax professionals ensure that tax returns are correctly prepared and submitted to the FTA, reducing the risk of errors and the potential for penalties.

- Representation and Dealing with FTA on Behalf of Businesses: In case of disputes or the need for negotiation with the FTA, having tax experts represent your business can be invaluable. They possess the expertise to present your case effectively and work towards a favorable outcome.

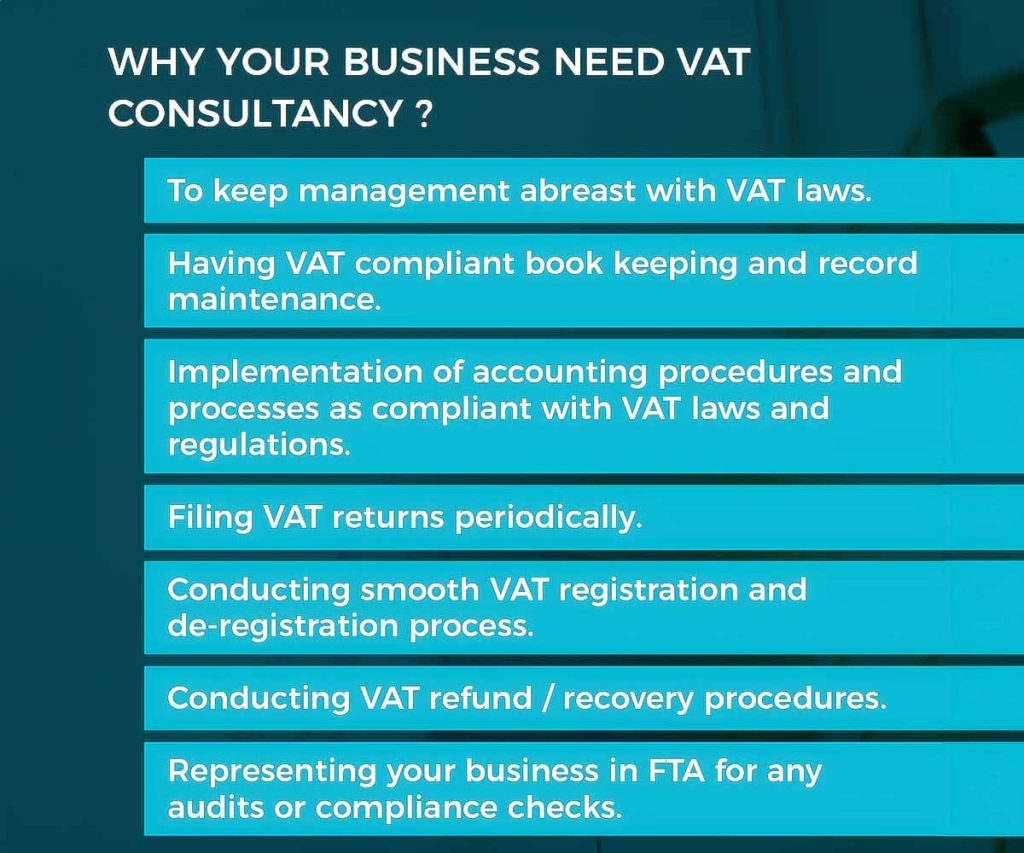

Navigating the VAT Maze: Why Expert Guidance is Essential for Your Business

Value Added Tax (VAT) presents a labyrinth of regulations and requirements businesses must navigate to ensure compliance and optimize their fiscal strategies. The intricacies of VAT administration demand expert oversight to safeguard against common pitfalls and leverage opportunities for financial efficiency. Below, we unravel the significance of each VAT service, underscoring the importance of professional support in this complex domain.

- VAT Registration and Ensuring Accurate Submission: Expert VAT services guide businesses through the registration process, ensuring that submissions are precise and compliant with regulations. This foundational step is critical for companies to operate legally and sets the stage for effective VAT management.

- Keeping Abreast of VAT Laws and Regulatory Changes: VAT laws are dynamic, with frequent updates and amendments. Professionals in VAT services keep businesses informed and compliant, navigating through the ever-evolving regulatory landscape to protect against inadvertent breaches.

- Evaluating VAT Impact on Business Cash Flow and Pricing Strategies: Understanding the impact of VAT on a company’s cash flow and pricing models is vital. VAT experts analyze these dimensions, providing insights that influence pricing, budgeting, and financial planning, ensuring that businesses maintain profitability while adhering to VAT obligations.

- Training Teams on VAT Compliance and Best Practices: Ensuring that internal teams are well-versed in VAT compliance and accounting practices is essential for maintaining financial integrity. VAT services include training staff to enhance their understanding of VAT processes and fostering a culture of compliance and efficiency.

- Preparation for VAT Audits and Effective Communication with Tax Authorities: VAT audits can be intricate and demanding. Specialists prepare businesses for these audits, offering representation and facilitating communication with tax authorities to ensure the process is conducted smoothly, minimizing the risk of penalties.

- VAT Planning to Leverage Tax Credits and Minimize Liabilities: Effective VAT planning can significantly reduce tax liabilities and enhance cash flow. VAT experts devise strategies that enable businesses to capitalize on tax credits and deductions, optimizing their tax position.

- Accurate VAT Filing and Payment Submission: Timely and precise VAT filing is paramount to avoid penalties and maintain good standing with tax authorities. VAT services ensure that filings and payments are accurate and submitted within deadlines, providing peace of mind to businesses.

- Representation and Advocacy in VAT Disputes: Having seasoned VAT professionals advocate on your behalf can be a game-changer in disputes or discrepancies with tax authorities. They possess the expertise to negotiate and resolve conflicts, securing favorable outcomes for the business.

VAT Consultancy

The cornerstone of our offerings is VAT consultancy, which allows us to gain comprehensive insight into a client’s business operations and evaluate how VAT affects their transactions. This evaluation covers the nature and volume of supplies, the calculation of VAT on sales and purchases, the possibility of applying reduced rates and exemptions, and the adequacy of record-keeping practices.

VAT Implementation

Our skilled consultants conduct detailed audits on all business segments that VAT regulations impact. This ensures that your business practices, documentation, and contracts align with VAT requirements. Adjustments in document formatting, contract language, and pricing strategies may be necessary to align with VAT implications.

VAT-Compliant Bookkeeping

We guarantee that your financial records are updated on time, ensuring transactions are recorded in accordance with VAT laws. This includes the preparation of invoices and credit notes following FTA guidelines, charging the accurate VAT amount on supplies, and correctly claiming input VAT on eligible transactions to prevent future penalties.

VAT Return Filing

Depending on your business size, VAT returns are filed monthly or quarterly, with strict adherence to deadlines to avoid penalties. These filings encompass declarations of various supplies, reverse charge transactions, imports, taxes paid, and all other relevant financial activities.

VAT Refund/Recovery

For businesses with input VAT exceeding output VAT, entitlement to a refund from the FTA exists. The FTA may request additional documents or explanations to process such refunds, ensuring compliance and validity of claims.

VAT De-registration

Businesses in the UAE must apply for VAT de-registration with the FTA under specific circumstances, such as ceasing taxable supplies or when taxable supplies dip below the required threshold. Prompt de-registration is crucial to avoid penalties, following the guidelines set by the FTA for VAT-related matters.

FIRST LINK Process

We take a proactive approach, anticipating challenges and adjustments to maintain momentum.

01

Comprehensive Consultation

Understanding your needs

Addressing your queries

Tailoring our approach

02

In-Depth Analysis

Identifying key challenges

Offering expert advice

Navigating complexities

03

Decision and Implementation

Crafting strategic actions

Tailored execution plans

Ensuring optimal outcomes