Net Income vs. Net Revenue: Understanding Your Company’s Financial Health

Net Revenue: The Top-Line Story

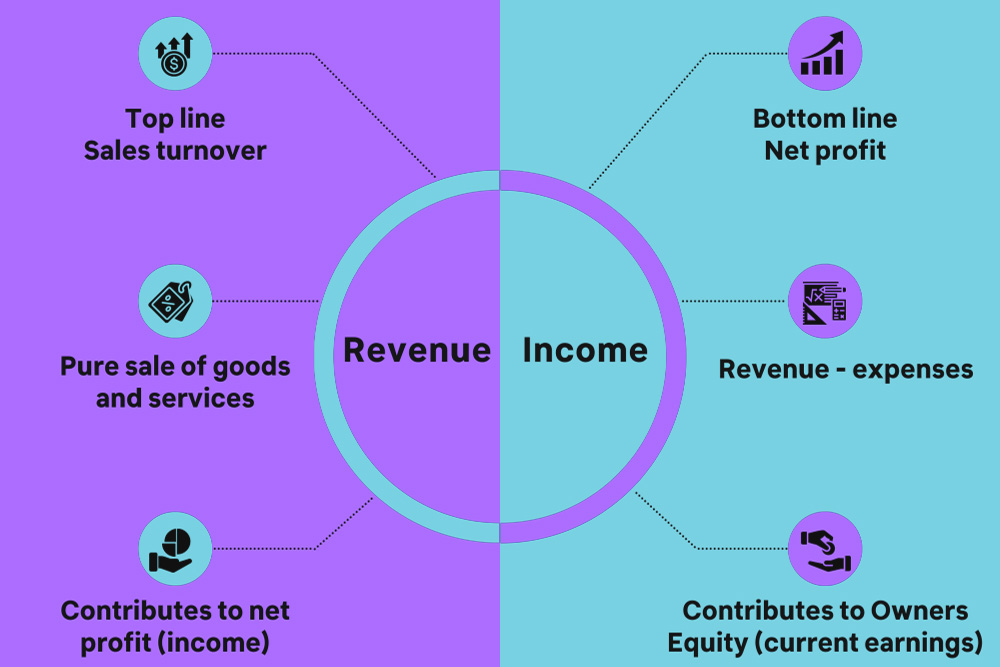

Net revenue, often the top line, represents the total income generated from sales of goods or services after deducting returns, allowances for damaged or missing goods, and any discounts allowed. It provides a snapshot of a company’s sales efficiency and market demand for its products.

Net Income: The Bottom Line

Net income, or the bottom line, delves deeper, showcasing what remains after all operating expenses, interest, taxes, and additional income streams are accounted for. It’s the definitive measure of a company’s profitability, indicating its ability to manage costs and generate earnings.

The Calculation Pathway

To arrive at net income, companies start with net revenue, subtracting the cost of goods sold (COGS) to find gross profit. Operating expenses, taxes, interest, and other incomes or expenses are then factored in, culminating in net income.

Why the Distinction Matters

Understanding the difference is crucial for stakeholders. While net revenue hints at sales success, net income provides a comprehensive view of overall financial health, including operational efficiency and cost management.

In Practice: A Closer Look

Consider a tech firm selling software. Its net revenue reflects gross sales minus discounts and returns. However, its net income will reveal the profitability after deducting salaries, R&D, marketing expenses, and taxes.

The Strategic Implications

Business strategies often aim to boost both figures. Enhancing net revenue might involve expanding market reach or improving product offerings, whereas increasing net income could focus on optimizing operations and reducing costs.

A Tale of Two Metrics

Ultimately, net income and net revenue narrate the story of a company’s financial journey from sales to profitability. Together, they provide a nuanced understanding of a business’s fiscal landscape, guiding strategic decisions.

Beyond Numbers

Net income and revenue are more than mere numbers on a financial statement; they are vital indicators of a company’s operational success and market position. Discerning their differences enables investors, managers, and stakeholders to make informed decisions, steering the company toward sustainable growth and profitability.

Understanding your company’s financial health is essential for making informed decisions and ensuring long-term success. In this context, two key financial terms often arise: net income and revenue. While they may sound similar, they represent distinct concepts and play different roles in measuring a company’s economic performance.

Net Revenue: A Measure of Sales

Net revenue, or net sales, refers to the total money a company generates from its core operations after subtracting returns, allowances, and discounts. Simply put, it’s the income earned directly from selling goods or services. It’s calculated by multiplying the selling price of a product or service by the number of units sold and then subtracting any returns or discounts offered.

For instance, imagine a company selling handmade wooden tables for AED1,000 each. If they sell ten tables in a month with a total discount of AED100, their net revenue for that month would be:

Net Revenue = (Selling Price per table x Number of tables sold) – Total discounts Net Revenue = (AED1,000/table x 10 tables) – AED100 Net Revenue = AED9,900

Net Income: The Bottom Line

Net income, also known as the bottom line, represents the profit remaining after all expenses have been deducted from net revenue. It reflects the company’s overall financial performance and profitability. To calculate net income, you start with net revenue and subtract all operating expenses, such as:

- Cost of goods sold (COGS)

- Selling, general, and administrative expenses (SG&A)

- Interest expense

- Depreciation and amortization

Continuing the previous example, let’s say the company incurs the following expenses in the same month:

- Cost of goods sold: AED4,000

- Selling, general, and administrative expenses: AED2,500

- Interest expense: AED500

- Depreciation: AED1,000

To calculate their net income, we would use the following formula:

Net Income = Net Revenue – Total Expenses Net Income = AED9,900 – (AED4,000 + AED2,500 + AED500 + AED1,000) Net Income = AED1,900

As you can see, the net income is considerably lower than the net revenue. The company has incurred various expenses to generate sales, which eat into its profits.

Understanding the Difference: Why It Matters

Distinguishing between net revenue and net income is essential for several reasons. Net revenue shows a company’s sales performance, while net income reveals its profitability. Investors, creditors, and other stakeholders use both metrics to assess a company’s financial health, growth potential, and ability to generate sustainable profits.

For example, a company might have a high net revenue but a low net income, indicating that it’s selling many products but struggling to control its expenses. Conversely, a company with a lower net revenue but a higher net income might operate more efficiently and generate better profits despite selling fewer products.

Net revenue shows how much money you bring in from sales, while net income reveals how much profit you’re left with after accounting for all your expenses. Both metrics are essential for making informed financial decisions and ensuring the long-term success of your business.